Investors

Do you want to contribute to impact investing?

If you are interested in learning more about impact investing, please contact us.

Target audience

- Qualified investors & Family offices

- Institutional investors, Fund of funds and Financial Institutions

- Multilateral organisations & Governments

- Non for profit organisations & Foundations

Active Funds & mandates

BUILD

Partnership with UNCDF

Financing small businesses primarily in the Least Developed Countries (LDCs), as an extension of UNCDF’s mission.

OMDF/DECIM (Madagascar)

Financing off-grid solar companies and financial institutions active in the off-grid solar sector in Madagascar.

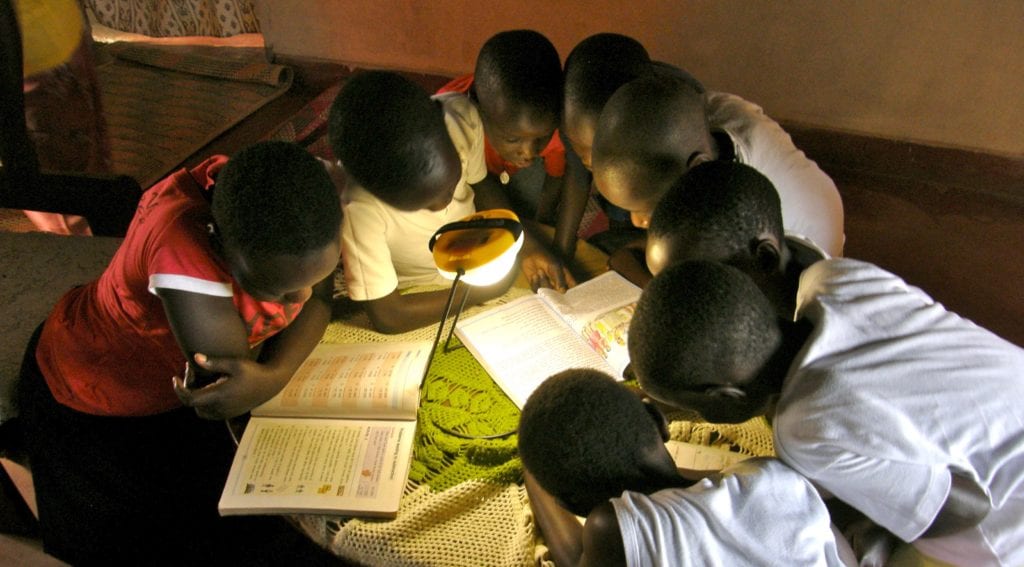

OGEF (Haiti)

Financing companies that provide renewable, off-grid energy access solutions in Haiti, with the objective to electrify 200,000 households in Haiti within the next 10 years.

BEAM

Providing equity capital for distributed energy service companies (DESCOs) and unlocking further financing through debt, joint-ventures and co-investments, to accelerate access to off-grid energy in sub-Saharan Africa and Asia.

BLOC Smart Africa

Partnership with the Smart Africa Alliance

Investing in tech-enabled African businesses in various sectors such as digital infrastructure, ag-tech, access to healthcare, and medical services, access to education, energy access and financial inclusion.

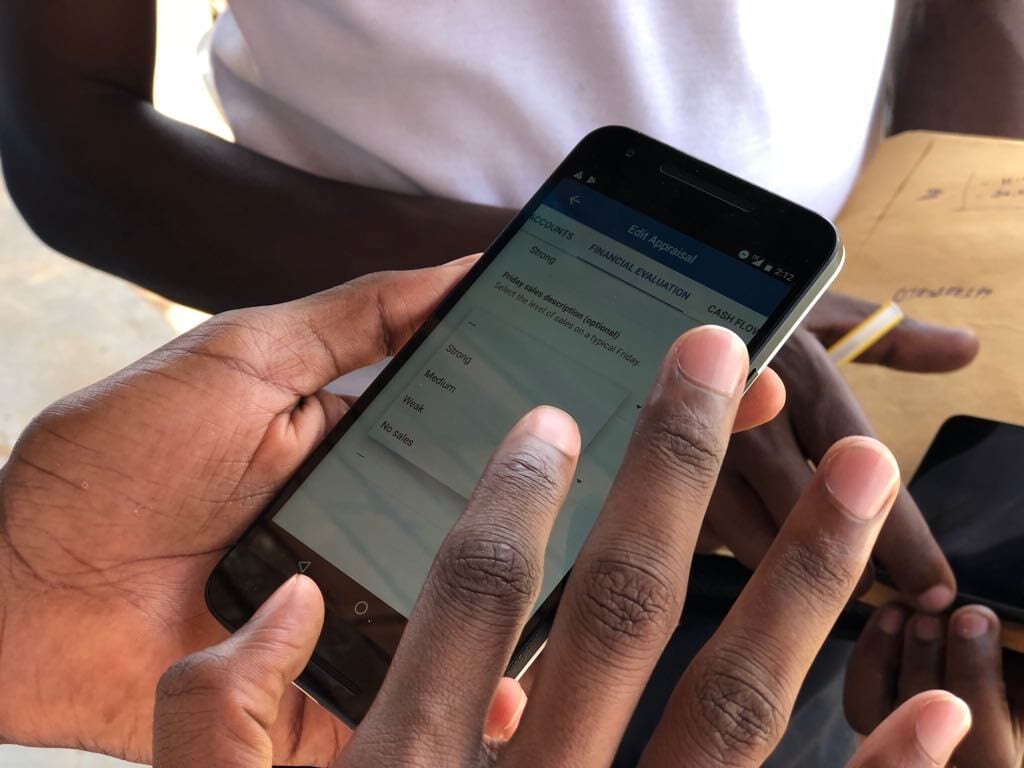

FINANCIAL INCLUSION II

Private equity investments to companies that scale financial inclusion, through business models ranging from microfinance institutions to Fintech money operators, correspondent banking, peer-to-peer lending, etc.

OASIS

Private equity investments to impactful business models in various sectors such as energy access (LPG gas, pico-solar, distributed solar energy, pay-as-you-go business models, mini-grids using technologies from biomass to solar, etc.), affordable education, access to healthcare, agriculture, affordable housing, etc.

Past Funds & mandates

Financial Inclusion Fund I

Private equity investments to companies that improve financial inclusion of underserved communities through microfinance.

Agri-Business Capital (ABC)

Financing and technical assistance to underserved yet profitable segments of agribusiness value chains in low- and middle-income countries, with the aim of improving rural livelihoods of smallholder farmers.

CARE-SheTrades

Partnership with CARE Enterprises

Financing and technical assistance to businesses that create prosperity by giving women and marginalized communities the power to envision and make change happen for themselves.

ESG Risk Management

Our Funds under management monitor both positive impact created through our investments, as well as Environmental, Social and Governance (ESG) risks. In alignment with the sustainability-related disclosures in the financial services sector (“SFDR”) Regulation, Bamboo discloses how ESG risks are integrated in investment decisions and monitored along the investment lifecycle.